Commerce media has emerged as one of the fastest-growing digital advertising channels, transforming how enterprise brands reach consumers in super high-intent environments. Retail media is the biggest slice of the commerce media pie. Powered by first-party data and closed-loop measurement, retail media connects media spend directly to sales across online and in-store channels, serving as a retailer-specific subset of commerce media that drives measurable growth through retailer-owned platforms.

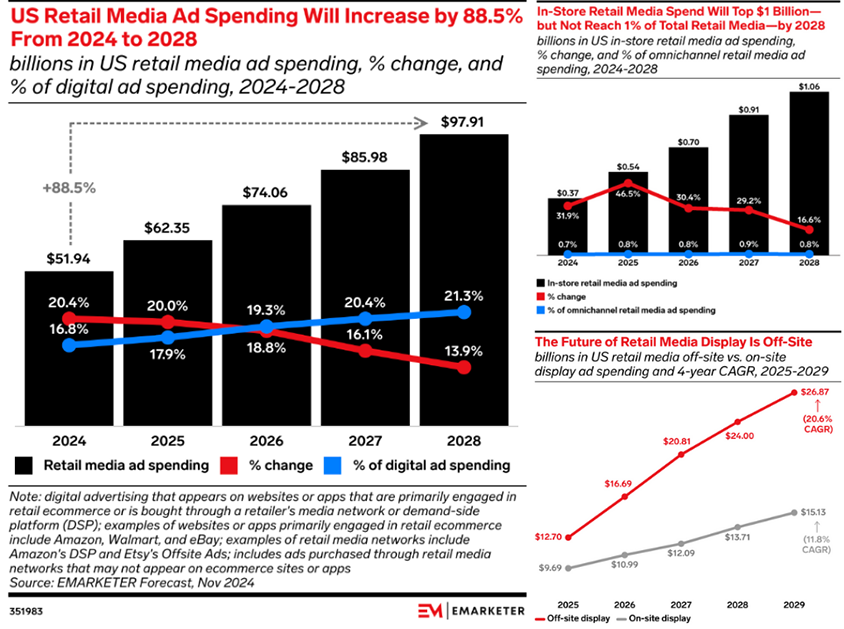

Specifically in the realm of retail media, an eMarketer’s Report has found that U.S. retail media ad spend is expected to exceed $62 billion in 2025, a jump of over $10 billion Y-O-Y. This momentum is being driven by expanding ad formats, richer targeting capabilities, and the integration of retail data into channels far beyond retailer websites (off-site retail media).

Equally transformative is AI. Generative AI tools are powering dynamic messaging, personalized recommendations, and creative versioning at scale. McKinsey finds that 73% of U.S. advertisers are likely to partner with Retail Media Networks (RMNs) that leverage AI for creative expansion and productivity.

Source: eMarketer

Performance marketers who once optimized large-scale campaigns across platforms like Google and Meta are now seeing a control shift toward retailer-owned ecosystems, where familiar strategies meet new constraints and opportunities. Here’s a comparison of the two:

Performance Marketing |

Retail Media |

Shared DNA |

What Changed |

| Search & Shopping (Google Search, Product Listing ads) | Sponsored Search & Sponsored Products (On-site search results) |

|

|

| Programmatic Display (open web/native) | Onsite Display & Native (homepage, category, PDP placements) |

|

|

| Video / YouTube / OTT | Retailer Video & CTV (onsite video & off-site CTV with retailer data) |

|

|

| Paid Social (Meta, TikTok) | Off-site Social using RMN Data (retailer audiences activated off-site) |

|

|

The performance marketer who once specialized in two or three dominant platforms now faces a patchwork of ecosystems each with its own rules, inventory, and data. Complexity is escalating fast due to:

- Full-funnel media expansion: RMNs now extend beyond sponsored search into display, video, CTV, and in‑store media.

- Off-site activation: RMNs are using shopper data to serve precise ads across social platforms, programmatic open web, and CTV.

- In-store media presence: eMarketer forecasts U.S. in‑store retail media spend will top $1 billion by 2028, still under 1% of total spend, but ripe with opportunity. Long a black box, in-store media is also becoming better measurable with first-party data and AI-powered attribution models.

Adapting to Multi-Channel Complexity

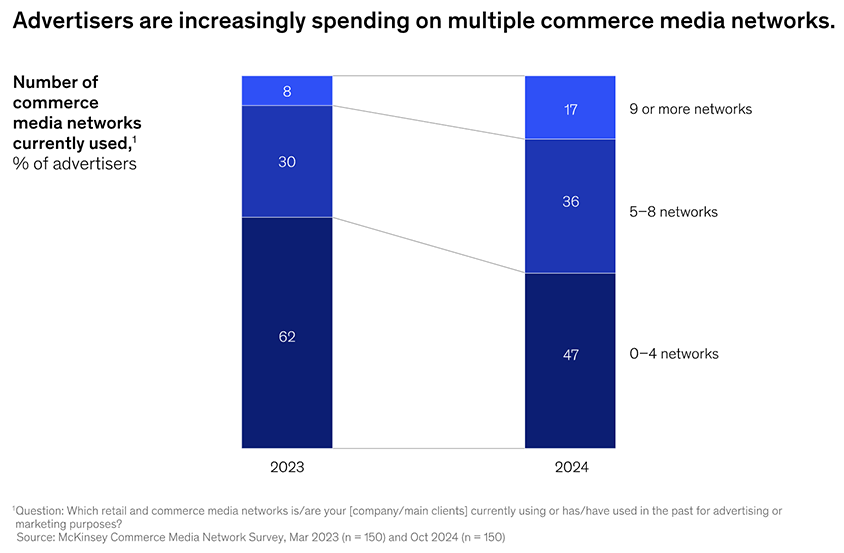

McKinsey data shows just how quickly multi-channel complexity is accelerating: 53% of advertisers used five or more Commerce Media Networks (CMNs) in 2024, up from 38% in 2023, meaning marketers are already juggling multiple partners and compliance rules at once. BCG reports that brands now allocate around 20 % of ad budgets to retail media, with most planning to increase that alongside RMN expansion.

Source: McKinsey & Company

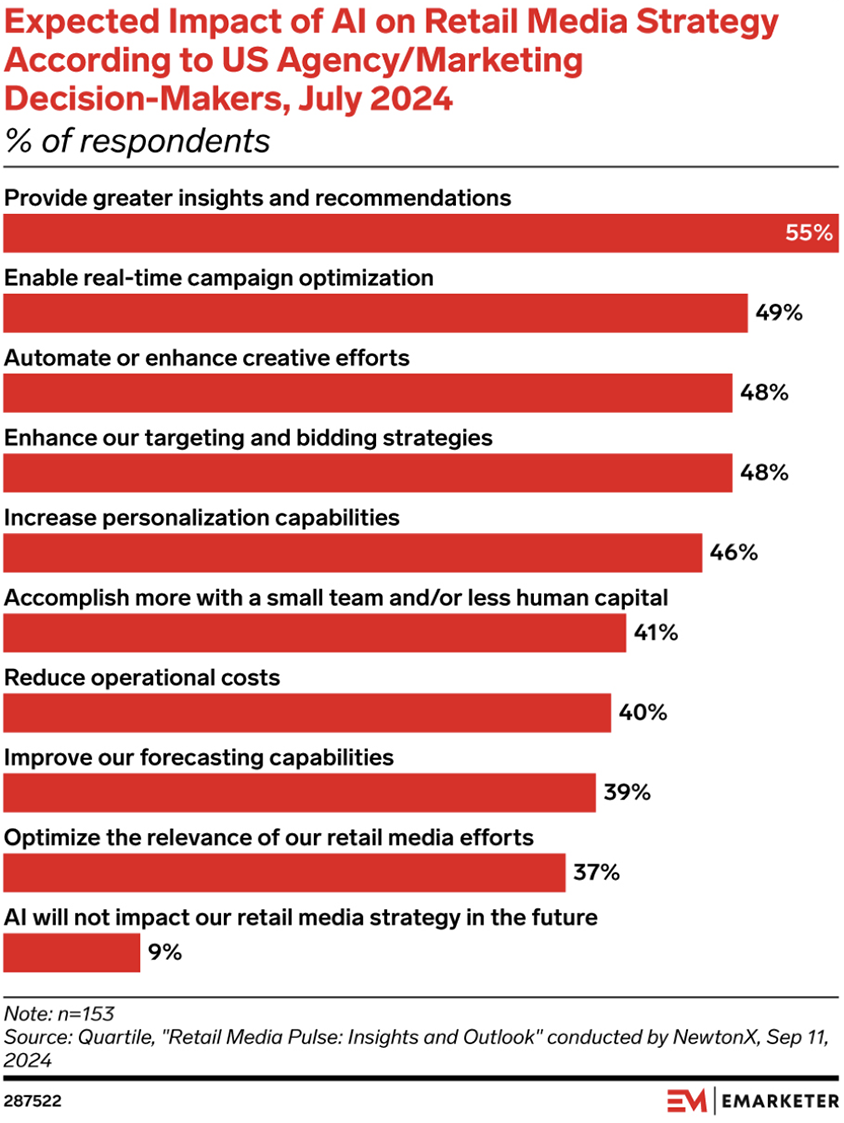

As this ecosystem fragments, AI is emerging as the operating system for retail media as 55% of marketers expect it to power recommendations, optimization, and personalization, according to an eMarketer report.

Agentic AI: From Optimization To Orchestration:

As retail media complexity plagues brands with fragmentation across networks, channels, and data sources, traditional AI systems built on rule-based logic or predictive models are hitting their limits. Designed primarily for optimization within fixed parameters, they lack the autonomy, memory, and goal-driven reasoning needed to adapt in real time. They can’t keep pace with the exponential growth of creative, SKU, and data combinations modern commerce demands.

Enter Agentic AI: autonomous systems that act on, not react to, data. Continuously reasoning toward business goals, Agentic AI makes contextual decisions in real time, orchestrating performance across every channel and product at scale.

Agentic AI systems can plan, prioritize, and execute tasks across the retail media lifecycle, much like a performance marketer. They can:

- Analyze first-party signals to determine which creative or SKU to promote at any given moment

- Dynamically generate or adapt creative variants for each retailer’s specs

- Allocate budgets or bids across networks based on performance feedback loops

In short, Agentic AI shifts marketing from a system of inputs to a system of intent, where growth teams set objectives and the AI autonomously drives toward them, learning and adapting continuously.

For marketers evolving into “retail media architects,” this means less manual orchestration and more intelligent collaboration with AI that acts as a co-strategist – executing, optimizing, and scaling campaigns at machine speed.

The Role Has Been Stretched:

The foundation of performance marketing still holds; measurement, iteration, ROI obsession. But the role has been stretched in three important ways:

- Less control, more orchestration: No more end-to-end ownership; instead, collaboration across creative, retail, and analytics is essential.

- From testing landing pages to testing SKUs: The unit of optimization has shifted from site experiences to retailer product detail pages.

- Creative as logistics: Traditional silos between media, brand creative, and retail teams no longer work. Creative must now be versioned by SKU, seasonality, and retailer compliance, turning creative execution into a supply-chain-like process.

It’s no surprise then that 48% of US marketing leaders expect AI to play its biggest role here, automating and enhancing creative efforts at scale.

Source: eMarketer

The overall outcome is not a replacement but an expansion: the performance marketer has evolved into the retail media architect, part media strategist and part creative ops lead.

Carrying Forward Performance DNA:

The evolution from static to dynamic execution shows how performance marketing DNA is being reapplied in retail media.

The experience of a leading U.S. grocer, Giant Eagle, is instructive: static creative versioning wasn’t enough. They shifted to dynamic, data‑driven ads auto‑updated with first‑party data across touchpoints.

By automating feed-driven creative production with DaVinci Commerce, they lifted CTR by 54%; proof that creative agility is the new performance lever in retail media.

Infrastructure For The New Role:

For marketers stepping into the “retail media architect” role, infrastructure is critical. They need systems that automate creative, unify media execution, and scale personalization. AI-powered platforms, like DaVinci Commerce, provide exactly that connective tissue: automating retail-ready creative production, enforcing compliance, and linking first-party data to dynamic creative decision-making.

This enables growth teams to stop managing fragmentation and start architecting the full retail experience.

A Role Rewritten:

The rise of retail media is not just a channel shift; it’s a career evolution. The next era of growth leaders won’t just optimize campaigns, they will architect commerce and retail ecosystems, leveraging orchestration across RMNs, creative precision, and AI-enabled scale.

The result is a new kind of marketer: the retail media architect, carrying forward the precision of performance marketing while expanding it to build the next era of commerce-driven advertising.